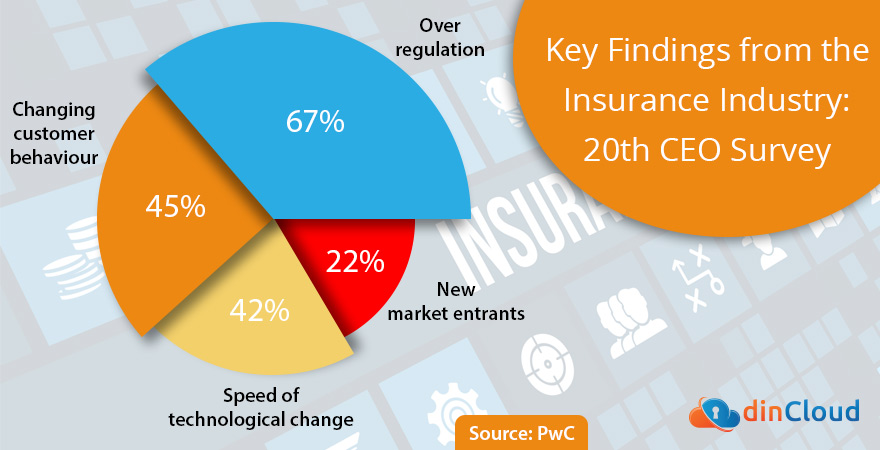

The insurance industry has seen disruptive changes with tremendous impact from trends in: over-regulation, speed of technological changes, customer behavior and competition in an increasingly saturated market.

According to a PWC survey of CEOs in the insurance market, measuring concern over disruption, 67% of respondents indicated “extreme concern” about over regulation, with 42% exhibiting “extreme concern” about the speed of technological change.

Why such concern? Not only are CEOs tasked with keeping up with technology, they’re faced with increased market competition and heightened consumer expectations, if they fail to keep pace.

New InsurTech entrants are also posing a big threat, as they boast slimmer margins that result in lower end user cost.

The good news for the many CEOs faced with this challenge, is that technology can also serve as a competitive advantage, if effectively integrated into business processes. In fact, 67% of these business leaders see creativity and innovation as “very important” to their organizations.

As technology continues to transform the business landscape, it also represents a huge opportunity for growth and profitability. 28% of insurance CEOs believe technology will completely reshape competition in the industry in the next five years and 58 % say it will have a significant impact.

The insurance industry is well positioned to take advantage of cloud services, the innovation at the center of recent technology transformation. Insurance companies can apply cloud technology in a number of ways that can prove impactful to their business, enabling:

- improved customer service

- increased efficiency in business operations

- reduced costs

All this translates to a competitive advantage that can be tremendously impactful on business performance.

To learn more about cloud services for the Insurance Industry visit our Insurance Industry page.